China Rare Earth Export Still Up in QTY & Down in Price in July 2016

[2016-10-13]

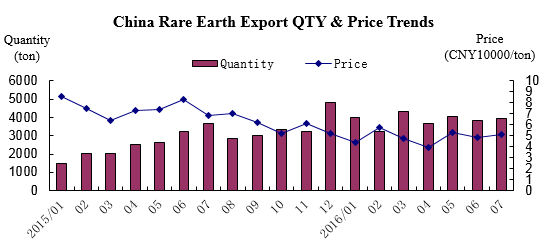

According to China Customs statistics, during January-July 2016, China exported rare earth 27,000 tons, up 54.8% year-on-year (YOY); worth CNY 1.32 billion, up 0.7% YOY; at average export price of CNY 48,000 per ton, down 34.9% YOY.

Ⅰ Characteristics of Rare Earth Export in July

(1) Single-month export quantity increased YOY for 15 consecutive months, with average export price down by double digit YOY for 8 consecutive months. This July, China exported rare earth 3944.9 tons, up 2.5% month-on-month (MOM) and up 7.8% YOY, showing 15 consecutive months of rising YOY; at average export price of 51,000 yuan per ton, up 5.3% MOM and down 25.7% YOY, showing double-digit decline YOY in the eighth consecutive month (see the chart below).

Ⅰ Characteristics of Rare Earth Export in July

(1) Single-month export quantity increased YOY for 15 consecutive months, with average export price down by double digit YOY for 8 consecutive months. This July, China exported rare earth 3944.9 tons, up 2.5% month-on-month (MOM) and up 7.8% YOY, showing 15 consecutive months of rising YOY; at average export price of 51,000 yuan per ton, up 5.3% MOM and down 25.7% YOY, showing double-digit decline YOY in the eighth consecutive month (see the chart below).

(2) Most of the export was by ordinary trade. This July, China exported 3880.9 tons of rare earth by ordinary trade, up 6.4% YOY, accounting for 98.4% of the total quantity; exported 64 tons under Customs special control, up 4.5 times YOY.

(3) More export went to EU and USA, while much less to Japan. This July, China exported rare earth 1086.3 tons to the EU, up 46% YOY, accounting for 27.5% of the total quantity; exported 1081.9 tons to the USA, up 13.3% YOY, accounting for 27.4% of the total; exported 946 tons to Japan, down 25.1% YOY, accounting for 24%; exported 279.3 tons to South Korea, up 78.2%, accounting for 7.1%.

(4) More than half of the export was made by private enterprises, while less by foreign-invested enterprises and state-owned enterprises. In July, China's private enterprises exported rare earth 2133.9 tons, up 54.1% YOY, accounting for 54.1% of the total quantity. Meanwhile, China’s state-owned enterprises and foreign-invested enterprises respectively exported 1216.7 tons and 594.2 tons, down 9.6% and 35.9% YOY, accounting for 30.8% and 15.1% respectively.

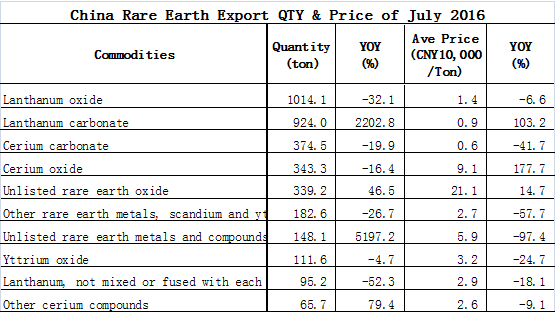

(5) Most products had double-digit decline in average export price, lanthanum carbonate increased much in export quantity. This July and last July, China respectively exported 26 rare-earth products (by HS 8-digit code statistics), with 20 products down YOY in export price mostly by double digit. Lanthanum oxide export quantity, ranking the first, reached 1014.1 tons down 32.1% YOY, and its export price was 14,000 yuan per ton, down 6.6% YOY; lanthanum carbonate export quantity reached 924 tons, 22 times more than last July, and its export price was 9,000 yuan per ton, twice last July (see the table below).

Ⅱ Causes of Rare Earth Export Up in QTY and Down in Price

(1) Rare-earth export quota and tariff were both canceled, thus beneficial to the export increase. In 2015, China canceled rare earth export quota and export tariff, significantly boosting the export momentum, especially that of small and medium exporters. In July, China's private enterprises exported rare earth 2133.9 tons, up 54.1% YOY, accounting for 54.1% of the total, making a contribution of 2.6 times to the export increase.

(2) International market oversupply got the prices down. In recent years, with external rare-earth resource exploitation, international rare-earth market has shown further oversupply. According to statistics, in 2015, global light rare-earth capacity was more than 2 times actual consumption. Meanwhile, the USA and Japan have enhanced recycling of waste rare earth, development of rare-earth-free permanent magnet, and popularity of dysprosium infiltration process, thus reducing the demand for rare earth. The oversupply resulted in rare-earth price decline.

Ⅲ Notable Problems and Relevant Suggestions

(1) "Unlicensed rare-earth production" is still rampant, with low price upsetting legitimate manufacturers. At present, China's rare-earth separation capacity is up to 450,000 tons per year, in which licensed capacity is 280,000 tons per year, accounting for 62.2% of the total, while remaining 37.8% capacity is due to unlicensed industrial chain2. By estimate, non-quota rare-earth output is about 63,000 tons per year in China, equivalent to 60% of annual output quota3. According to Shanghai Customs investigation, illegal rare earth is cheaper by 15% in average price than legitimate rare earth, thus making legitimate manufacturers have to lower supply prices, with big impact on their proceeds of business.

(2) Chinese rare-earth application is relatively laggard, with high-end products mostly imported from overseas. At present, China still lags far behind developed countries in terms of rare-earth basic research and high-end application. Homemade rare-earth materials and devices cannot meet the requirements for high performance and quality stability by national defense industry and emerging strategic industries, so the country has to be dependent on import for high-end rare-earth products. For instance, on the Chinese market of rare-earth permanent magnets, 65% of high-end products are imported4. As a result, Chinese high-end users have no right in price negotiation and have to bear highflying market prices. Over the first half year, the average price of China-imported rare-earth permanent magnets was 591,000 yuan per ton, 81.8% more than that of China-exported rare-earth permanent magnets.

Keywords:Rare Earth

Related Articles: